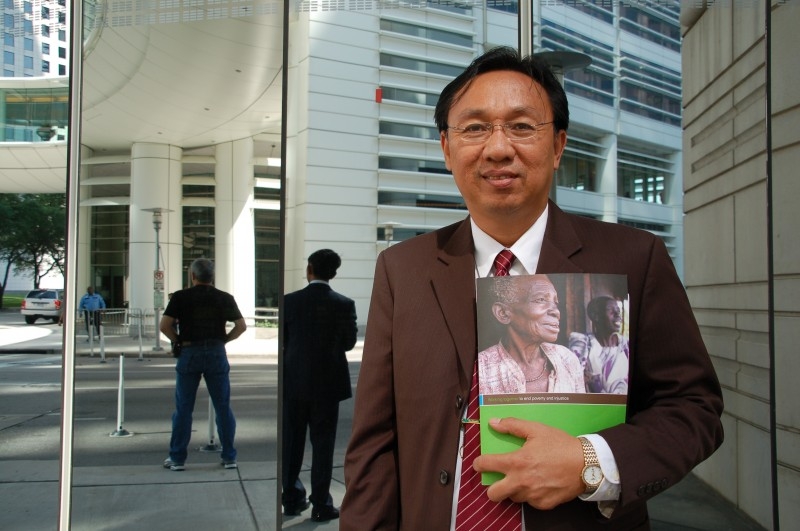

At Chevron’s annual meeting, shareholders representing approximately 160 million shares, worth more than $10 billion, voted in favor of a proposal calling for a transparent payment disclosure policy. Mam Sambath traveled more than 9,000 miles from Cambodia to Houston to share a simple message with Chevron: Tell us about the money you are spending in our country, so we can use some of it to help lift our people out of poverty.

Mr. Sambath attended the Chevron annual shareholders’ meeting as a proxy for Charles Schwab and Company, holding shares on behalf of an individual shareholder. His day job is as Chairperson of Cambodians for Resource Revenue Transparency (CRRT), an organization working to ensure that wealth generated from the oil industry is managed in a socially responsible manner that is transparent, accountable and participatory in order to benefit all Cambodians. “To date, we know nothing about payments that have been made to Cambodian governments upon signing the contracts,” Mr. Sambath said at the annual meeting. In 2004, Chevron announced that it had made significant discoveries of oil offshore in Cambodian waters. The company is scheduled to start oil production here in 2012. Mr. Sambath went on to explain that there was no good way to hold those governments accountable without transparency about payments made from Chevron to the governments of the countries where it operates. “Access to information on revenues will empower us to hold our government accountable for using oil revenues for economic development and basic social services like education and healthcare,” he said. Chevron shareholders heard the arguments from Mr. Sambath and Ian Gary, Oxfam America’s Senior Policy Manager for Extractive Industries, before voting in favor of the proposal, which requests that Chevron report its payments to foreign governments for extraction rights on an annual and country-by-country basis.

Gary said: “Too often, these revenues increase the potential for government mismanagement, corruption and economic and political instability. These risks ultimately affect Chevron’s core business and its reputation.”

But, if managed properly, he said, these funds could contribute to broad-based economic growth.

The shareholder proposal was filed in December 2009 by Oxfam America and five institutions with Chevron holdings. Prior to the vote in late May, shareholders and their proxies spoke in favor of this proposal to help reduce instability and insecurity in oil-rich countries through a transparent and accountable payment disclosure policy in all countries where Chevron operates. Two other global oil companies, Statoil of Norway and Talisman Energy of Canada, already disclose this information to the public.

While shareholder resolutions are non-binding, support for them demonstrates the interests of shareholders and can influence company policies. To this end, Oxfam America will continue to raise concerns about revenue transparency with Chevron management and shareholders, and will consider re-filing the resolution again late this year.